Getting on with Business

One of the decisions any businessperson has to make is whether to outsource services that their business needs or to manage them in house.

There is no shortage of outsource solutions. IT, virtual receptionists, laboratory services, marketing services, website optimisation, graphic design and business broking services to name just a few.

Our opinion has always been that if someone can do something better, quicker and deliver a solid ROI then you should outsource that service.

At Lily Head Finance we fulfil all those criteria that validates an outsource solution. We help healthcare clients get the best finance deals with the best terms.

In this case study I wanted to share how with the help of our client we turned around a proposal in a matter of days.

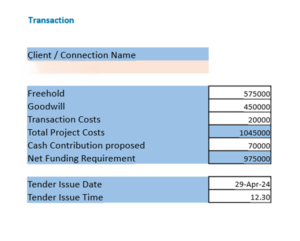

We sent our client an F1 request on a Friday. The client sent everything back over the weekend and the tender with our Tier 1 lending panel was launched at 12:30 on Monday.

At 16:50 on the Tuesday I sent the client a summary of presentation terms from five banks.

It would not be possible for anyone to go direct to a bank and get indicative terms this quickly, let alone terms from five banks.

The prospective buyer of the practice gets the best deal, choice and can move forward quickly with confidence. This may even enable them to get ahead of other prospective buyers who are slow to get funding agreed.

The seller knows early that the buyer is on track with underwritten facilities and that they can move forward in confidence with the buyer.

There are no downsides.

This case study was written article was written by Christian Reilly, Associate Director at Lily Head Finance.

Please Contact Us to learn more about how this protects you and ensures you get the best even handed advice possible.